Below is a summary of the key temporary requirements that are being implemented in 2022: Fannie Mae, Lender Letter (LL-2021-14)

These new additional requirements could make it harder for unit owners to refinance or for new buyers to obtain mortgages. In practice, this meant that a unit owner seeking to refinance or a potential buyer seeking to obtain a mortgage on a unit would not be able to from traditional banks or lenders that seek to sell the mortgages on the secondary market, forcing them to opt for cash deals or to find a local lender that would hold and service the mortgage.Īs a result of and following the Surfside collapse, Fannie Mae and Freddie Mac have issued bulletins regarding “temporary” additional requirements for mortgages obtained for condominiums and cooperative residential units.

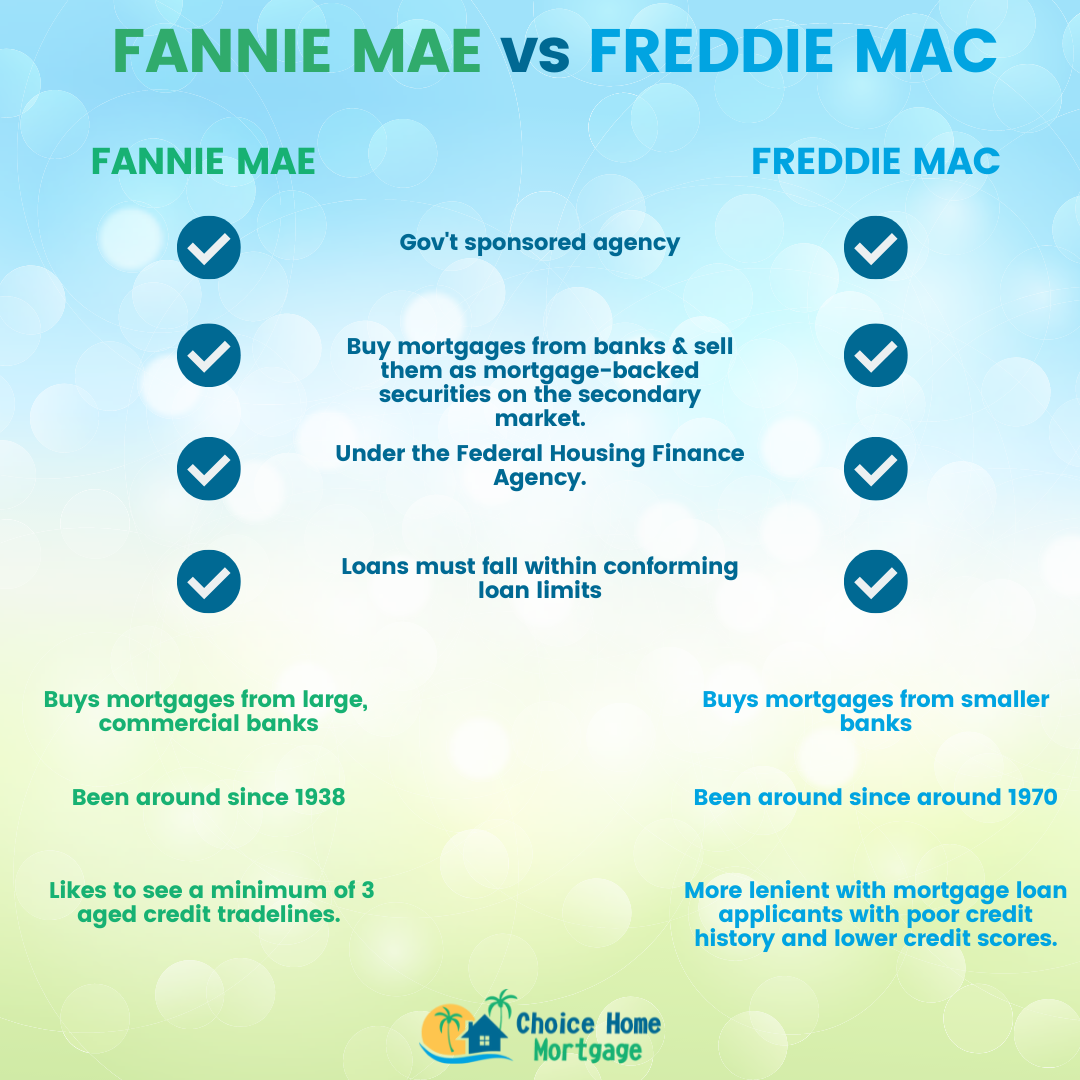

Prior to the Surfside collapse, condominiums and cooperatives that were in litigation were deemed “ineligible projects” for the purposes of Fannie Mae and Freddie Mac eligibility. This functions to provide liquidity to the residential mortgage market and acts as a guarantee to the originating banks and lenders. Neither entity issues or services their own mortgages, but rather purchases mortgages from originating banks to hold the mortgages or sell as mortgage-backed securities. Put simply, Fannie Mae and Freddie Mac (officially known as the “Federal Home Loan Mortgage Company”) are quasi-governmental entities that were established by Congress to create a secondary market for residential mortgages. In light of this tragic event, secondary mortgage market giants, Fannie Mae and Freddie Mac have issued bulletins advising of new “temporary” requirements for mortgages issued in connection with condominiums and cooperatives. The collapse of the Champlain Towers South in Surfside, Florida, in June 2021, sent shockwaves throughout the United States and was a wake-up call to condominiums to the dangers of aging infrastructures.

0 kommentar(er)

0 kommentar(er)